Global-e Online, the one-stop shop for global e-commerce !

How to take advantage of the strong growth in this market with a healthy and revolutionary player in its field. I present it to you here

Short view :

Company : Global-E Online Ltd.

Ticker : GLBE

Market cap : $6.41B

Revenue : $752.76M

EBITDA : $101.6M (13.5% EBITDA margin)

EV/Sales : 6.3 ntm

EV/EBITDA : 31.7x NTM

Introduction

Global-e Online Ltd. (NASDAQ: GLBE) stands at the forefront of the global e-commerce revolution, empowering retailers and brands to seamlessly expand their direct-to-consumer (D2C) sales across borders. Founded in 2013 and headquartered in Petah Tikva, Israel, Global-e provides an end-to-end platform that simplifies the complexities of international e-commerce, from localized checkouts to logistics and compliance. With operations spanning over 200 countries and a client base of over 1,000 merchants, including global giants like Adidas and LVMH, Global-e is redefining how businesses connect with international shoppers. As cross-border e-commerce continues to grow at a 10% CAGR, Global-e’s innovative solutions position it as a critical enabler in a $1 trillion market. This presentation explores Global-e’s history, core activities, strategic vision, key relationships, financial performance, and future prospects, offering a holistic view of its role in shaping the future of global retail.

History of the Company

Global-e Online was founded in 2013 by Amir Schlachet (CEO), Shahar Tamari (COO), and Nir Debbi (President), with a mission to make international e-commerce as simple as domestic sales. Starting as a niche solution for cross-border checkout optimization, the company quickly gained traction by addressing pain points like currency conversion, tax compliance, and shipping logistics.

Key milestones include:

2016: Secured early funding from investors like Apax Partners, fueling platform development.

2018: Partnered with major brands like Adidas and Marks & Spencer, establishing credibility in enterprise retail.

2021: Went public on NASDAQ, raising $431M at $25 per share, with a valuation of ~$3.6B. The IPO marked a turning point, providing capital for global expansion.

2023: Acquired Borderfree from Pitney Bowes for $100M, enhancing localization and logistics capabilities.

2024: Achieved record-breaking growth, with Q4 GMV exceeding $1.37B and full-year revenue of $750M, cementing its leadership in cross-border e-commerce.

From a startup to a publicly traded powerhouse, Global-e’s journey reflects its ability to innovate and scale in a rapidly evolving market.

Activities

Global-e operates a comprehensive platform that streamlines every aspect of cross-border e-commerce, enabling retailers to sell globally with minimal friction. Its core activities include:

Localized Checkout: Supports 100+ currencies, 50+ languages, and region-specific payment methods (e.g., Klarna, WeChat Pay), ensuring a seamless shopping experience.

Payment Processing: Integrates with providers like PayPal, Stripe, and Adyen, offering fraud protection and transparent duty/tax calculations.

Logistics and Fulfillment: Partners with carriers like DHL, FedEx, and local providers to optimize shipping, returns, and customs clearance. The Borderfree acquisition enhanced reverse logistics capabilities.

Compliance and Data Analytics: Ensures regulatory adherence (e.g., GDPR, tariffs) and leverages AI-driven analytics to optimize pricing, product recommendations, and conversion rates.

Platform Integrations: Seamlessly connects with e-commerce ecosystems like Shopify, Salesforce Commerce Cloud, Magento, and BigCommerce, enabling rapid deployment for merchants.

Global-e’s platform serves both D2C brands and marketplaces, processing over $4.5B in GMV in 2024 alone. Its technology stack, including Docker, NoSQL, and Salesforce, supports scalability and innovation, making cross-border sales as intuitive as local transactions.

Strategy

Global-e’s strategy is built on four pillars: technological innovation, ecosystem expansion, geographic diversification, and operational excellence. Key elements include:

AI and Machine Learning: Invests heavily in AI to enhance checkout personalization, predict consumer behavior, and optimize pricing. Automated catalog analysis (introduced in 2024) allows merchants to sell more products in more markets.

Strategic Partnerships: Deepens integrations with platforms like Shopify (e.g., Shopify Markets Pro) and payment providers to simplify merchant onboarding and scale GMV.

Geographic Expansion: Targets high-growth regions like APAC (Japan, South Korea) and LATAM, building on its stronghold in the US and Europe. Partnerships with Transcosmos (Japan, South Korea) support this push.

Mergers and Acquisitions: Acquires complementary technologies, such as Borderfree (2023), to enhance localization and logistics capabilities.

Customer-Centric Solutions: Focuses on reducing friction (e.g., transparent duties, fast shipping) to boost conversion rates, with non-GAAP gross margins improving to 45.7% in Q3 2024.

Sustainability: Offers eco-friendly shipping options and invests in carbon-neutral initiatives to align with ESG trends.

This multi-pronged approach positions Global-e to capture a growing share of the $1T cross-border e-commerce market, projected to grow at 10% CAGR through 2030.

Customer and Supplier

Customers

Global-e serves over 1,000 merchants, ranging from enterprise retailers to mid-market D2C brands. Its client base spans verticals like fashion, luxury, beauty, and electronics, with notable customers including:

Luxury: LVMH (Kenzo, Pucci, Repossi), Versace, Harrods.

Fashion: Adidas, Forever 21, Victoria’s Secret (launched in 2024 for Canada and Europe).

Beauty: Kylie Cosmetics, Maison Francis Kurkdjian.

Tech/Other: Dyson, Everlane.

The platform caters to merchants with international ambitions, particularly those seeking to penetrate high-value markets like the US, Europe, and APAC. In 2024, Global-e reported a 35% YoY GMV growth, driven by new merchant launches and expansion with existing clients.

Suppliers

Global-e relies on a robust network of strategic suppliers to deliver its services:

Logistics: Partners with DHL, FedEx, UPS, and regional carriers for shipping and returns, leveraging pre-negotiated rates to reduce costs.

Payments: Integrates with PayPal, Stripe, Adyen, and Klarna to support 100+ payment methods globally.

Technology: Collaborates with e-commerce platforms (Shopify, Salesforce Commerce Cloud, Magento) and marketing tech providers (Klaviyo) for seamless integrations.

Compliance: Works with tax and regulatory specialists to ensure adherence across 200+ markets.

These supplier relationships are critical to Global-e’s ability to offer a scalable, cost-effective solution, with supplier synergies contributing to a 190-basis-point gross margin expansion in 2024.

Partnerships

Global-e’s success is underpinned by a rich ecosystem of partnerships that enhance its platform’s reach and functionality. Key partnerships include:

Shopify:

Strategic alliance since 2021, with Global-e powering Shopify Markets Pro (launched 2023) and native integrations for Shopify Plus.

2024 enhancements include support for Checkout Extensibility and alternative payment methods, driving 30%+ GMV growth on Managed Markets.

Shopify holds 12.94 % of the company's shares and with that, Shopify is the first shareholder of GLBE

DHL:

Strategic alliance since 2015, , providing Global-e with access to relevant DHL clients as well as preferred service and shipping rates

DHL holds 10.98% of the company's shares

Financial Analysis

Global-e’s financial performance in 2024 underscores its leadership in cross-border e-commerce, with record-breaking growth and improving profitability. Below is a detailed analysis :

Revenue:

Q4 2024: $262.9M, +42% YoY (service fees: $117.3M; fulfillment: $145.6M).

FY 2024: $752.8M, +32% YoY, driven by 37% GMV growth to $4.86B.

Key driver: Onboarding of large merchants (e.g., Harrods, Victoria’s Secret) and expansion in APAC.

Profitability

:Q4 2024 Non-GAAP Gross Profit: $120.9M, +53% YoY; margin at 46% (up from 42.7% in Q4 2023).

Q4 2024 Adjusted EBITDA: $57.1M, +62% YoY; margin at 21.7%, achieving a long-term IPO target.

Q4 2024 GAAP Profitability: First quarter of positive net income as a public company. Net profit in the fourth quarter of 2024 was $1.5 million

FY 2024 Adjusted EBITDA: $140.8M, +51.8% YoY.

Valuation Metrics (May2025):

Market Cap: $6.41B (share price $37.83, 169.4M shares).

P/S Ratio: 8.5x (based on $752.8M revenue), high but below historical peaks (11.5x median).

EV/EBITDA: 55.6x LTM, reflecting growth investments.

Compared to Shopify: P/S 12.7x, Global-e trades at a discount due to a number of factors: still a small player, head office outside the US, future profitability

Balance Sheet:

Cash & Equivalents: $474M, bolstered by IPO and secondary offerings and by $163M FCF in 2024 generating $63.1M net change in cash.

Debt: No financial debt

Current ratio : 2.1 and Quick ratio at 2

GLBE is in a very healthy and strong financial position. This means it can look forward to the future and pursue its M&A strategy.

2025 Guidance:

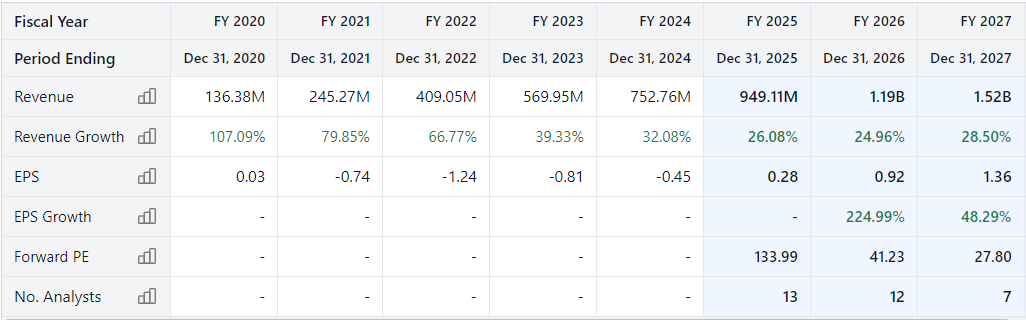

Revenue: ~$949.11M annual run-rate, implying 26%+ growth.

Adjusted EBITDA Margin: >20% for FY 2025.

GMV: Expected to grow 30-35% YoY, driven by new merchant launches and Shopify partnership.

Global-e’s financials reflect a balance of rapid growth and improving margins, with a path to sustainable profitability by 2025. However, its high P/S ratio suggests investor expectations for continued outperformance.

Outlook

Global-e is well-positioned to capitalize on the $1T cross-border e-commerce market, but it faces both opportunities and challenges as it scales.

Growth Drivers:

Market Expansion: Global e-commerce is projected to grow at 10% CAGR through 2030, with cross-border sales outpacing domestic growth.

Merchant Adoption: Strong pipeline of new clients (e.g., Victoria’s Secret, Harrods, Logitech, FC Barcelona…) and high net dollar retention rates (123% in 2024) drive GMV growth.

Shopify Partnership: Shopify Markets Pro and native integrations are expected to contribute 30%+ of GMV in 2025.

AI Innovation: Investments in predictive analytics and personalization will boost conversion rates and merchant loyalty.

Opportunities:

Emerging Markets: APAC (Japan, South Korea) and LATAM offer untapped potential, with partnerships like Transcosmos accelerating penetration.

New Verticals: Expansion into healthcare, home goods, and B2B e-commerce could diversify revenue streams.

M&A: Further acquisitions (e.g., payment or logistics tech) could enhance platform capabilities.

Challenges:

Macro Risks: Inflation, currency fluctuations, and consumer spending slowdowns could impact GMV growth, as noted in Q1 2025 guidance concerns.

Competition: Amazon Global Selling, in-house solutions by large retailers, and niche players pose threats.

Client Retention: Loss of high-margin clients (e.g., Ted Baker’s insolvency) could pressure margins, though diversified client base mitigates this risk.

Regulatory Complexity: Evolving data privacy laws (e.g., GDPR) and tariffs require ongoing investment in compliance.

Forecast:

Revenue: 25-30% CAGR through 2027, reaching ~$1.52B by 2027.

GMV: 30%+ annual growth, potentially hitting $10B by 2027.

Profitability: GAAP profitability in 2025; Adjusted EBITDA margin of 22-25% by 2027.

Analyst Consensus: 12-month price target of $52 (range: $40-$65), implying 38.5% upside from $37.83 (May 2025).

If we value GLBE on P/S multiples close to Shopify's for 2025, we can target a price per share of $73, a possible appreciation of +92%.

For investors, Global-e offers a compelling growth story, but its high valuation and macro sensitivities warrant caution. Monitoring Q1 2025 results (May 14, 2025) will be critical to assess GMV trends and margin expansion.

I would like to point out that I am a shareholder in the company. This article does not constitute a recommendation to buy or sell. I do not intend to buy or sell GLBE in the next few days.