Harrow Inc, a fast growth eyecare pharma, who will become champion in the long term !

Is a $47 Price Target for 2026 and +100$ in 2027 Realistic? Analyzing Harrow Inc.'s Growth Potential

Short view :

Company : Harrow Inc.

Ticker : HROW

Market cap : $992.58M

Revenue : $199.6 million in 2024

Adj EBITDA : $40.3 million for FY 2024

EV/Sales : 4.4x ntm

EV/EBITDA : 16.0x ntm

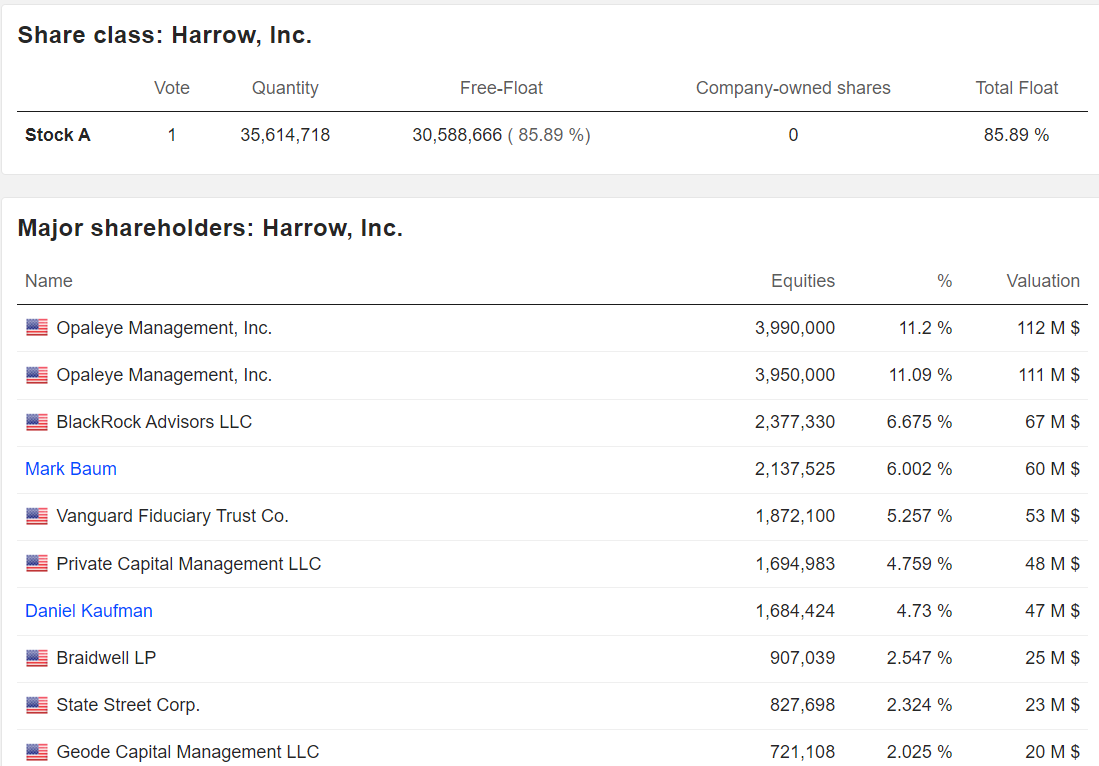

History and Shareholders

Founding and Evolution: Harrow, Inc. was founded in 2012 by Mark L. Baum, its current Chief Executive Officer, with a mission to address unmet needs in the ophthalmic pharmaceutical market. Initially operating through its ImprimisRx subsidiary, Harrow focused on compounded formulations before evolving into a branded pharmaceutical company through strategic acquisitions and product development. The company rebranded from Imprimis Pharmaceuticals to Harrow, Inc. to reflect its broader vision in eyecare.

Shareholders: Harrow’s investor base includes institutional investors and retail shareholders. The company has historically raised capital through equity offerings and debt financing (e.g., $219.5 million in debt as of 2024). Mark L. Baum, as founder, likely retains a significant stake. Harrow also holds a 44% equity stake in Melt Pharmaceuticals, a related entity developing MELT-300.

Activities and Products

Harrow, Inc. is a leading North American eyecare pharmaceutical company specializing in the development, production, and commercialization of ophthalmic drugs. Its portfolio spans branded prescription medications, over-the-counter (OTC) products, and compounded formulations, targeting conditions like glaucoma, dry eye, ocular inflammation, infections, and surgical needs.

Key Branded Products:

IHEEZO: A topical ocular anesthetic launched in May 2023, showing >40% sequential quarterly growth in Q4 2024 (49,130 units demanded).

VEVYE: A cyclosporine-based treatment for dry eye disease, launched in January 2024, with 63,925 prescriptions in Q4 2024 (per IQVIA data).

TRIESENCE: An FDA-approved corticosteroid for vitrectomy visualization (420,000 procedures/year) and posterior uveitis (100,000 diagnoses/year), relaunched with a J-Code (J-3300) and CMS pass-through status effective April 1, 2025.

Anterior Segment Portfolio: Includes steroids (e.g., Maxitrol, TobraDex ST), NSAIDs (e.g., ILEVRO, Nevanac), antibiotics (e.g., Vigamox), antifungals (Natacyn), antihistamines (ZERVIATE), and anti-glaucoma drugs (IOPIDINE), plus an OTC lubricant (FreshKote).

Compounded Formulations:

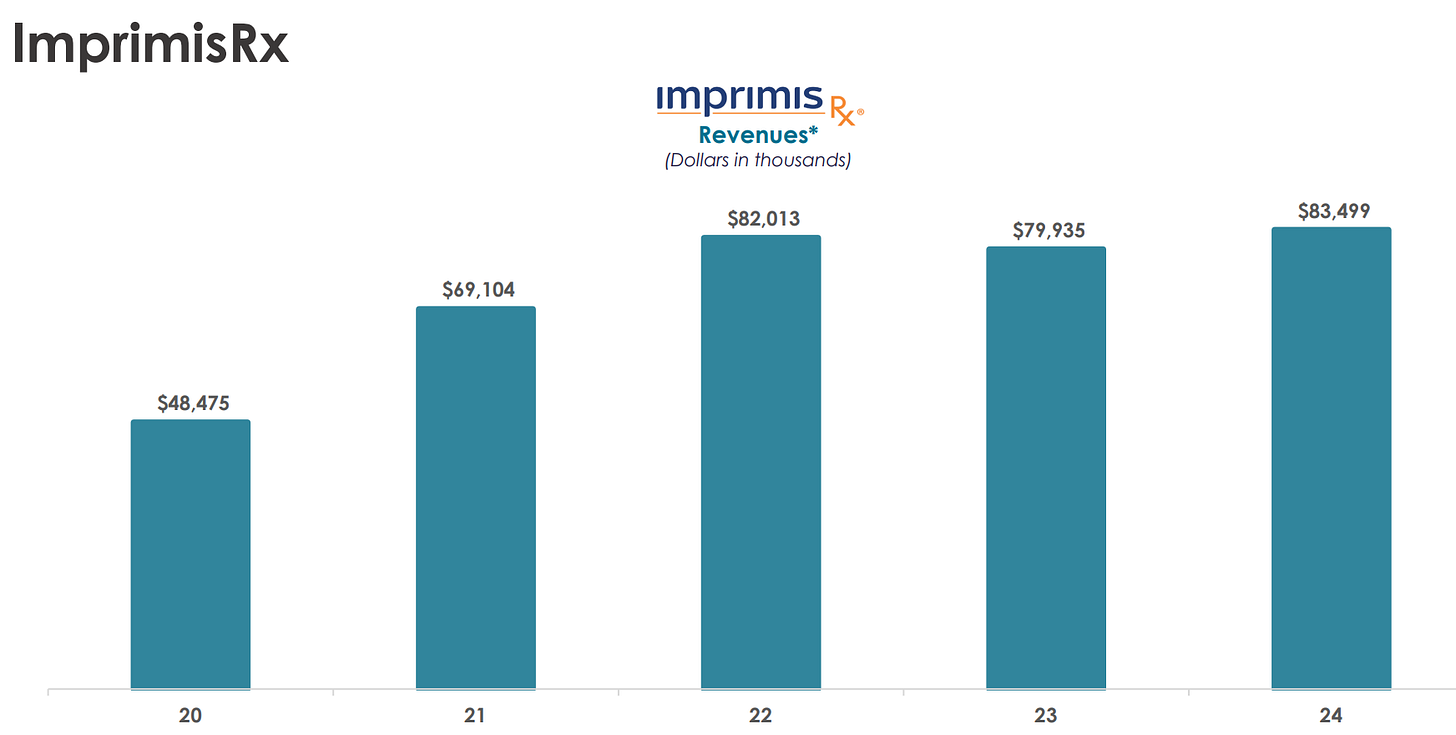

Through its ImprimisRx subsidiary, Harrow offers non-FDA-approved compounded ophthalmic products, generating $83 million in revenue in 2024 (up from $80 million in 2023).

Pipeline and Investments:

Harrow owns a 46% stake in Melt Pharmaceuticals, which reported positive Phase 3 data for MELT-300 (a non-IV, non-opioid sublingual sedation drug) in Q4 2024, with an NDA filing planned for H1 2026. Harrow also holds a 5% royalty interest and a right-of-first-refusal on MELT-300 commercialization.

Market Focus: Harrow targets the $11 billion U.S. ophthalmic pharmaceutical market, serving ophthalmologists, optometrists, retina specialists, and patients.

Strategy

Harrow’s strategy revolves around growth, innovation, and accessibility in the eyecare sector:

Portfolio Expansion: Acquiring and relaunching established brands (e.g., TRIESENCE, Vigamox) while developing new products (e.g., IHEEZO, VEVYE) to address niche markets.

Revenue Growth: Targeting >$280 million in revenue for 2025 (a 40%+ increase from $199.6 million in 2024), driven by key product demand and market penetration.

Operational Efficiency: Improving gross margins (79% GAAP, 84% core in Q4 2024) and adjusted EBITDA ($40.3 million in 2024, up from prior years) through scale and cost management.

R&D and Partnerships: Investing in next-generation products (e.g., TRIESENCE development) and leveraging its Melt Pharmaceuticals stake for future sedation market entry.

Accessibility Initiatives: Partnering with Cencora for the “Harrow Cares” program (launched 2025) to enhance affordability and access for retina specialists and patients.

Social Responsibility: Supporting mission trips (e.g., See Intl, Health in Sight Missions) with product donations, aiding nearly 5,000 patients across 18 countries in 2025.

Intellectual Property: Securing patents (e.g., TRIESENCE patent expiring 2029, MELT-300 patents in key markets) to protect its portfolio.

Clients and Suppliers

Clients:

Healthcare Providers: Ophthalmologists, optometrists, retina specialists, and surgery centers are primary clients, purchasing products directly or via distributors.

Patients: End-users of Harrow’s prescription and OTC products, often through physician prescriptions or pharmacy channels.

Distributors: Harrow works with distributors to supply surgery centers and clinics (e.g., IHEEZO unit demand reflects this channel).

Suppliers:

Contract Manufacturing Organizations (CMOs): Harrow has a five-year supply agreement with a CMO for TRIESENCE production, ensuring supply chain stability.

Raw Material Providers: Sourcing active pharmaceutical ingredients (e.g., cyclosporine for VEVYE, triamcinolone for TRIESENCE) from specialized suppliers, though specific names aren’t disclosed.

Partners: Collaboration with Cencora for distribution and affordability programs, and equity ties with Melt Pharmaceuticals for R&D synergy.

Financial Snapshot

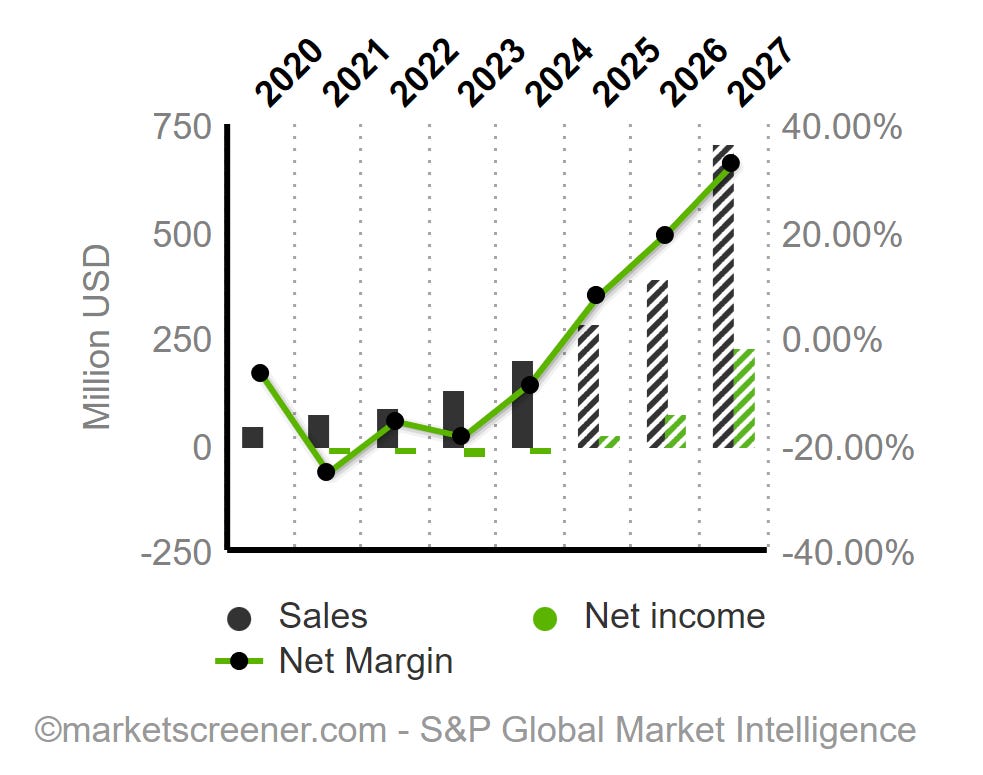

Harrow is undoubtedly a high-growth company.

Over the past ten years, the annualized revenue growth rate has been 61.4%, which is impressive.

Over the last three years, sales have accelerated significantly, with revenues rising from $72 million in 2021 to $199 million in 2024.

The latest quarter set a record in terms of sales ($67 million), gross margin ($53 million), and EBITDA ($18 million).

This growth stems from all of the company’s activity sectors/products:

IHEEZO: Up +43% in the quarter (49,130 prescriptions), generating $23 million.

VEVYE: Up 44% (63,925 prescriptions), generating $16 million.

Anterior Segment Products: Up $5 million year-over-year (YoY).

ImprimisRx: Up $500K YoY.

The improvement in EBITDA over the year 2024 can be explained by several factors:

Margin improvement: Gross margin increased from 69.55% to 75.33% in 2024. The new segment products, IHEEZO and VEVYE, are driving higher margins.

Sales growth.

Regarding operating cash flow generation, Harrow ended 2024 with a CFO (Cash Flow from Operations) of -$22.2 million, following a significant increase in DSO (Days Sales Outstanding), particularly in Q4 with -$62.78 million and -$80.23 million for the full year 2024.

Concerning this point of concern, it can be explained by two factors:

The payment cycle for the company’s proprietary branded products has longer delays compared to the revenue from ImprimisRx products.

In 2024, extended additional terms were granted to our largest distributor to allow downstream users and end users (e.g., hospitals, clinics, and ambulatory surgery centers) of certain branded products additional time to pay for these branded products.

This inability to generate operating cash flow, combined with a company that continues to invest heavily to fuel its growth, results in a cash outflow of approximately -$26.84 million for the year. This loss is partially offset by additional borrowing of $29.8 million.

The leverage remains reasonable, with a final net leverage ratio of 4.42x based on adjusted EBITDA ($40.3 million), but it is less favorable at 8x when using standard data ($22.13 million EBITDA).

Forecast

Revenue projected at >$280 million, representing an increase over 2024 revenue of more than 40% in annual revenues, reflecting confidence in product momentum and market expansion.

Following the trend of the last few quarters, 2025 is expected to be the first year with accounting profits for the company. Analysts anticipate earnings per share (EPS) of $0.53.

Additional products : MELT-300 could provide additional revenue to Harrow. Harrow owns a 46% equity stake in Melt Pharmaceuticals, which is developing this innovative, non-IV, non-opioid sedation drug for procedures like cataract surgery. If MELT-300 gains FDA approval (with an NDA expected in H1 2026 following positive Phase 3 results in Q4 2024), Harrow would earn a 5% royalty on its sales, tapping into a market of over 5 million annual U.S. cataract surgeries and potentially 100 million short-duration procedures. Harrow’s option to commercialize MELT-300 could further boost revenue by integrating it into its ophthalmic portfolio, leveraging existing distribution channels.

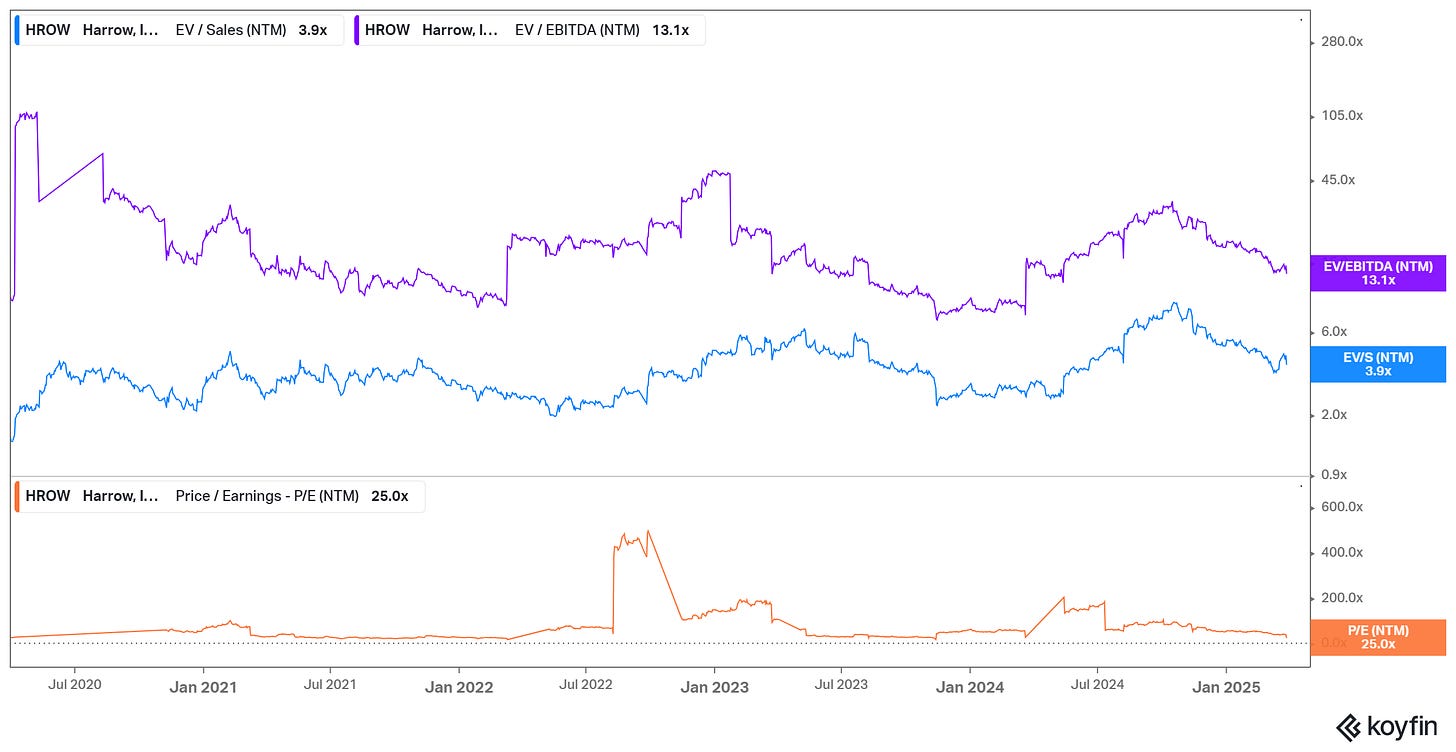

Valuation

To put it simply:

Buy now, it's buying at ~4x 2025 sales, for +40% sales growth.

Buy now, it’s buying at ~13x 2026 EPS.

But it's actually more complicated than that, because of Harrow's business. If we assume an average P/S ratio of 5x, which is reasonable for a company expected to double its revenue within two fiscal years, we can estimate a 2026 price target of $56. However, this PT remains highly speculative, as it relies on the assumption of exceptionally strong growth, which may be difficult to achieve.

Additionally, it is crucial to monitor the DSO. If it continues to rise, the company could face liquidity issues in the near future.

If we want to take a more conservative approach, we can base our valuation on EPS and use the P/E ratio. For 2027, analysts project EPS of $5.28, following $1.90 in 2026 and $0.58 in 2025—demonstrating exceptional earnings growth.

Given such outstanding profitability growth, we can apply a P/E growth multiple of 20x, which results in a 2026 price target of $38 and a 2027 PT of $105.60.

For 2026, we arrive at an average price target of $47, representing an appreciation of over 70% compared to the current level (March 2025).

I am currently a shareholder of the company. These posts are not a recommendation to buy. You must do your own research.

There appears to be a bear raid on the stock regarding potential refinancing. What dies HROW's debt maturity profile look like?