Three small-cap ideas could generate significant returns in the future.

Discover three small-cap with great financial data and great outlook. Zedcor, Eton Pharma and Kits Eyecare !

Hello, dear readers! Today, I share with you three small-cap stocks with remarkable financial performance and even brighter prospects for the future. Let’s dive right in!

#1 - ZEDCOR - ZDC.V

What does Zedcor do?

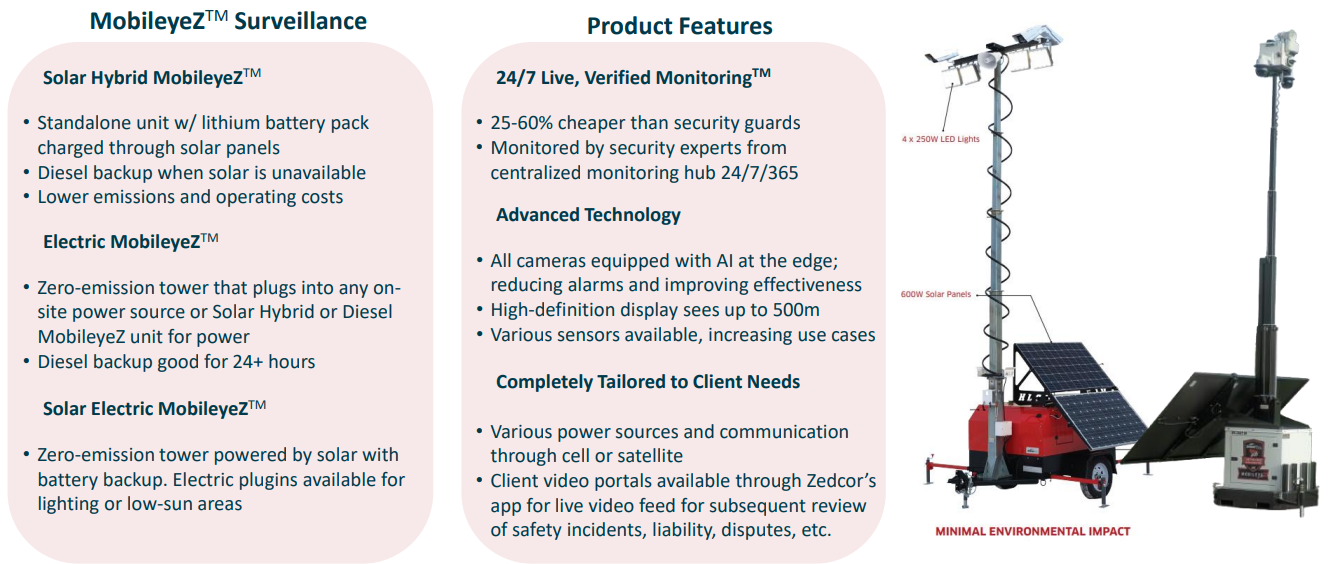

Zedcor Inc., based in Calgary, Canada, and founded in 2005, provides technology-based security and surveillance services across North America. Its primary offering is the MobileyeZ™ security tower, a mobile unit equipped with AI-enabled cameras, radar, and dual power options (solar, electric, or diesel) for 24/7 monitoring. Zedcor serves industries such as construction, retail, oil and gas, and mining, with over 1,300 towers deployed across Canada and U.S. states like Texas and Colorado. Additional services include fixed-site surveillance and security personnel, supporting clients like major North American retailers and infrastructure firms.

Financial Performance.

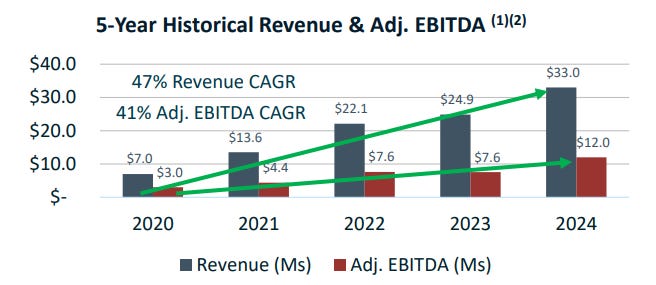

For Q1 2025, Zedcor reported revenue of $11.5M, a 87% increase year-over-year, and Adjusted EBITDA of $4.1M, up 116% YoY, reflecting a 36% margin despite U.S. expansion costs.

Full-year 2024 revenue was $33M, up 33% from $24.9M in 2023, with Adjusted EBITDA at $12M, a 57% rise.

Zedcor’s balance sheet is supported by a $25M equity raise and a $30M credit facility from ATB Financial, completed in Q4 2024, enhancing liquidity for growth.

Outlook.

Zedcor anticipates continued revenue growth in 2025, driven by a fleet utilization rate above 90% and 229 new MobileyeZ towers deployed in Q1 2025. The company is expanding into Arizona, California, and Tennessee, with U.S. operations contributing over 29% of Q1 2025 revenue.

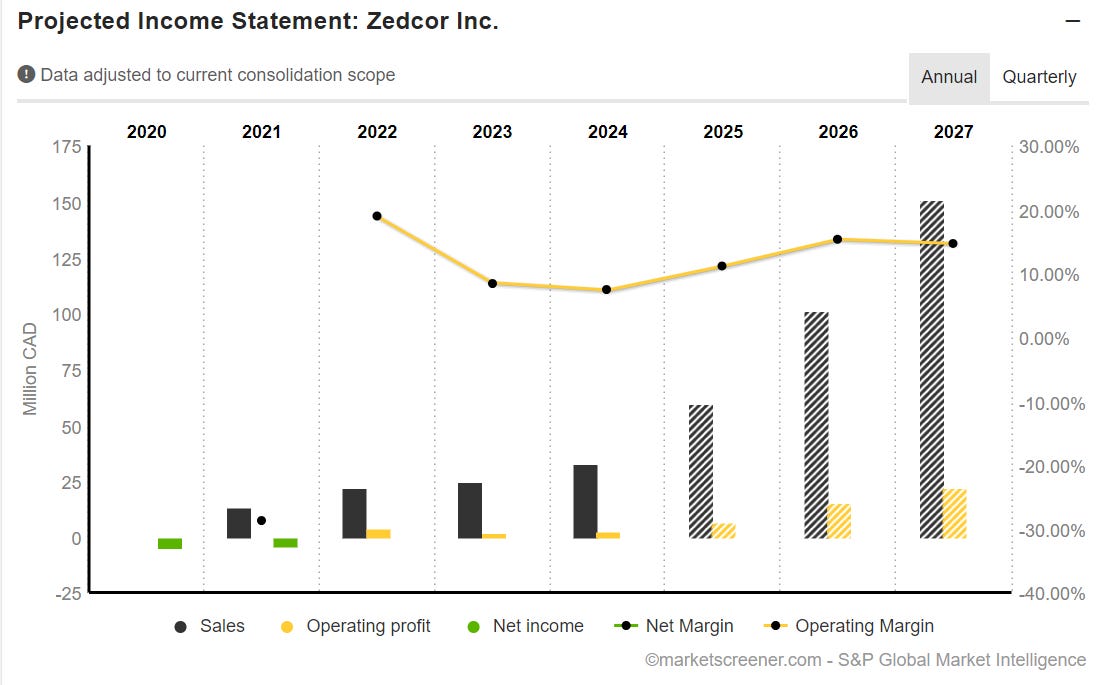

Analysts forecast earnings per share of C$0.05 for 2025, rising to C$0.20 by 2027. Potential risks include tariff exposure and reliance on construction sector demand, though diversified clients and AI-driven efficiency provide resilience.

Valuation.

At C$3.55 per share (June 2025), Zedcor’s market cap is C$368.76M. Its P/S ratio is approximately 11,1x, high compared to industrial peers, and its P/E ratio is 122x, reflecting growth expectations. Analysts’ price target of C$4.63 suggests a 30% upside. The stock’s 50-day moving average is C$3.2, indicating recent stability after volatility.

In summary, Zedcor’s technology-driven security solutions, strong financial growth, and U.S. expansion position it for continued progress, though its high valuation warrants careful consideration.

#2 - ETON Pharmaceutical - ETON

What does Eton do?

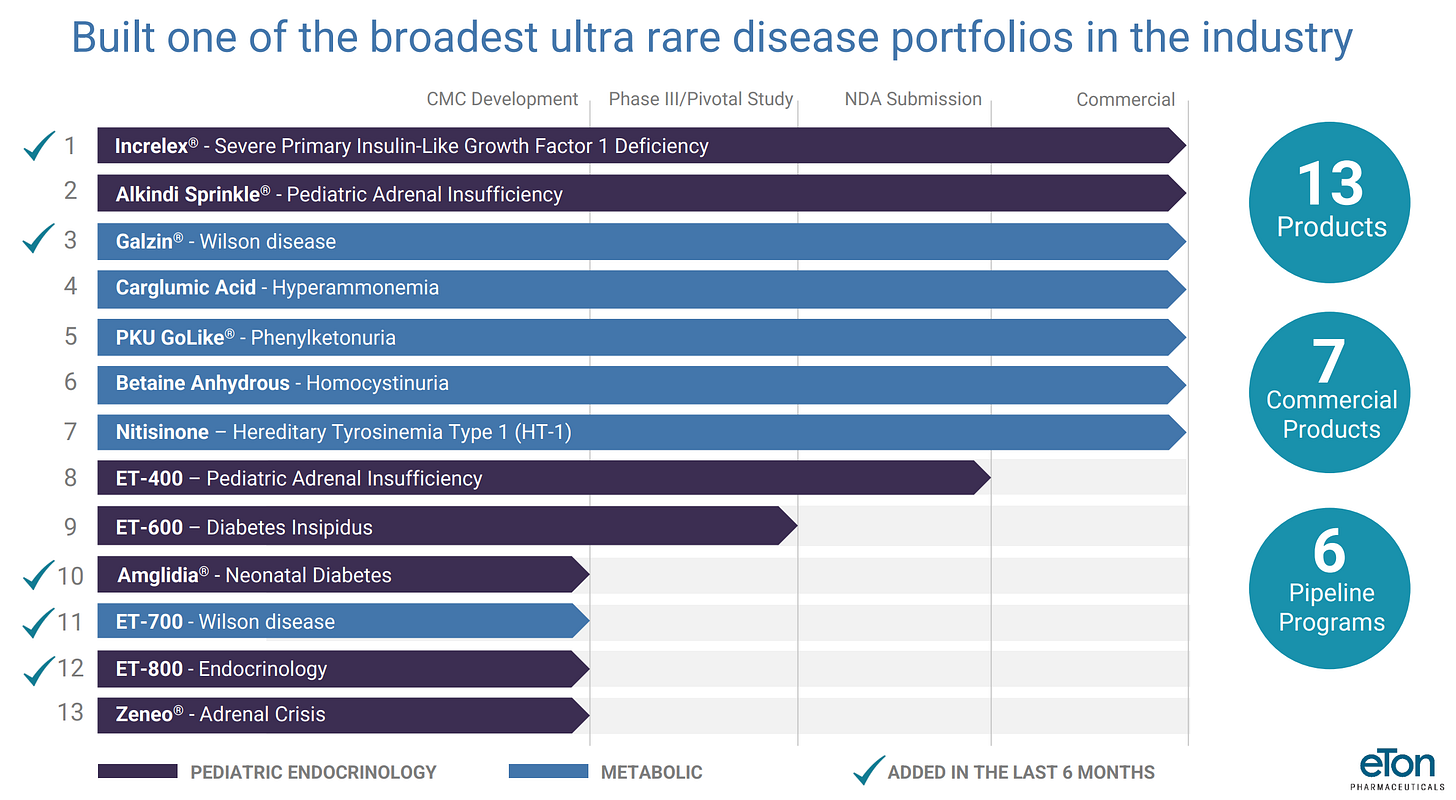

Eton Pharmaceuticals, based in Deer Park, Illinois, and founded in 2017, is a specialty pharmaceutical company focused on developing and commercializing treatments for rare diseases using the FDA’s 505(b)(2) pathway. Its seven commercial products include Increlex for severe primary IGF-1 deficiency, Alkindi Sprinkle for pediatric adrenal insufficiency, Galzin for Wilson disease, PKU Golike for phenylketonuria, Carglumic Acid for N-acetylglutamate synthase deficiency, Betaine Anhydrous for homocystinuria, and Nitisinone for tyrosinemia type 1. Eton also develops late-stage candidates like ET-600 for diabetes insipidus and ZENEO hydrocortisone autoinjector for adrenal crisis, targeting unmet needs in pediatric and metabolic disorders.

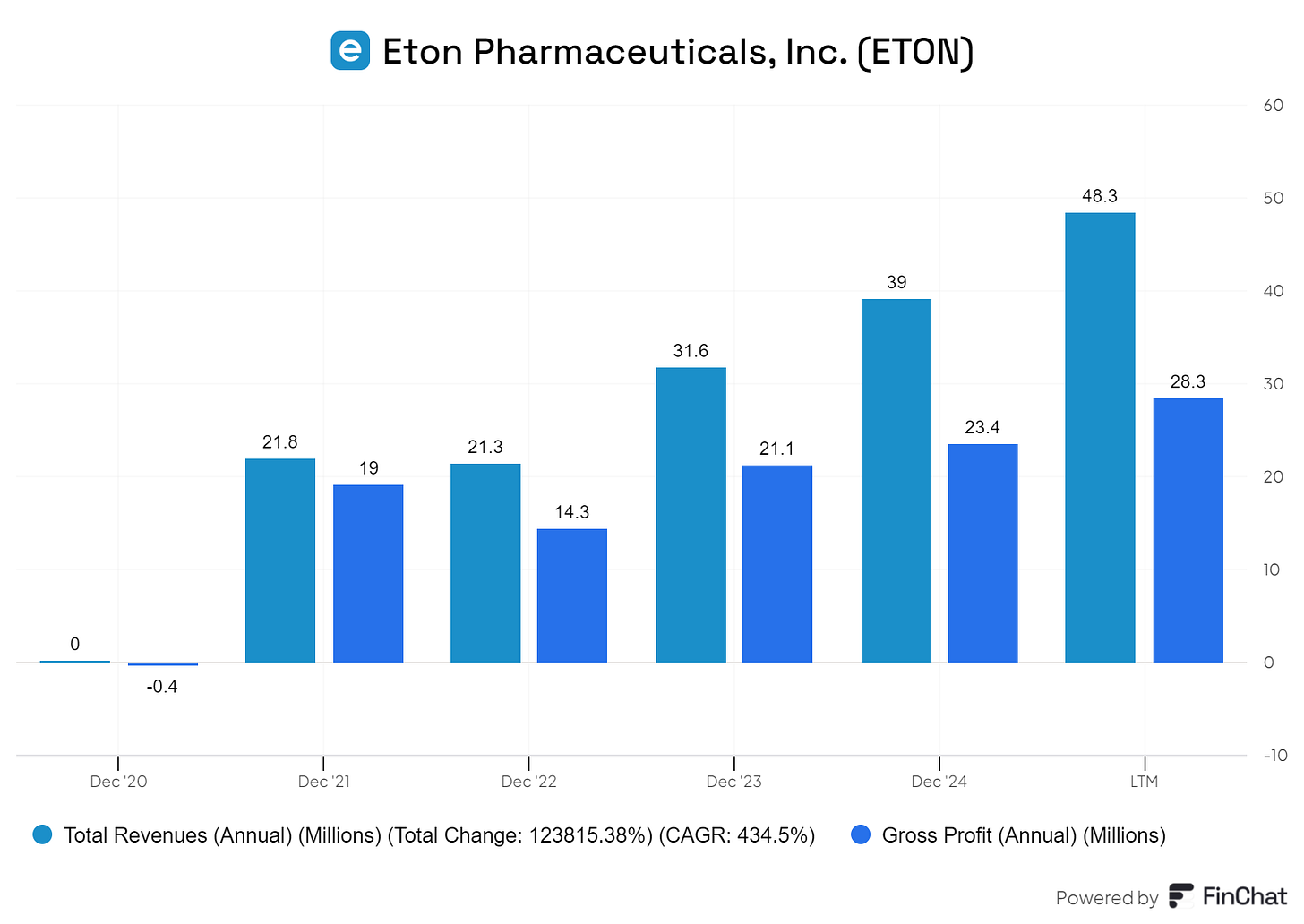

Financial Performance.

In Q1 2025, Eton reported total revenue of $17.3M, including $14.0M in product sales (up 76% year-over-year) and $1.8M from licensing, driven by Increlex and Alkindi Sprinkle. This marked the 17th consecutive quarter of sequential product sales growth. The company achieved a Non-GAAP net income of $1.8M ($0.07/share), beating analyst estimates of $0.03/share.

Full-year 2024 revenue was $39.01M, up 23.3% from 2023, but losses were $3.82M due to acquisition costs. As of March 31, 2025, Eton held $17.42M in cash, with a current ratio of 1.97 and a debt-to-equity ratio of 1.23.

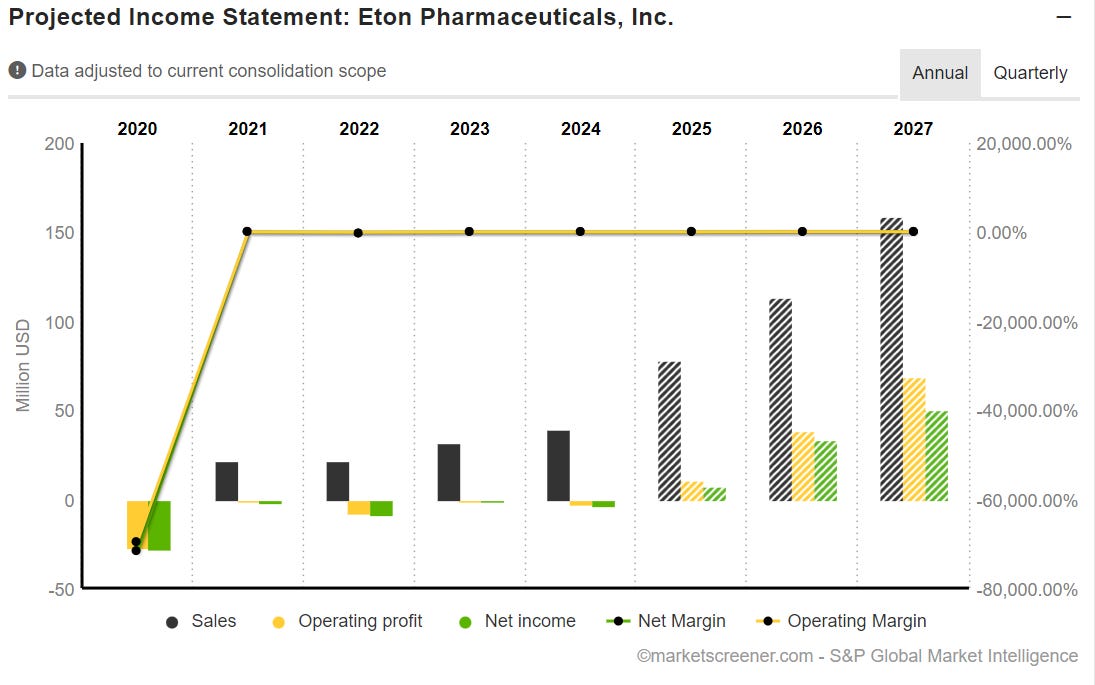

Outlook.

Eton anticipates sustained growth in 2025, driven by recent launches of Increlex and Galzin, which added significant new patients in Q1 2025. The FDA approved Khindivi (hydrocortisone oral solution) in May 2025, with a commercial launch in June, targeting a $200M market alongside Alkindi Sprinkle. The NDA for ET-600 was submitted in April 2025, with a potential Q1 2026 launch. Analysts expect three product launches in 2025, but risks include regulatory delays and competition in the rare disease space. Eton aims to have 10 commercial products by year-end 2025, supported by its Eton Cares patient support program.

Valuation.

At $16.84 per share (June 2025), Eton’s market cap is $451M with 26.82M shares outstanding.

Its trailing P/S ratio is 9.12x and its P/E is negative due to 2024 losses. The consensus price target from three analysts is $29.67, suggesting a 76% upside, with a “Strong Buy” rating.

The stock has risen 362% over the past 52 weeks, but its beta of 1.28 indicates above-average volatility. Eton’s valuation reflects optimism for its pipeline and acquisitions, though its high P/S warrants caution.

In summary, Eton’s focus on rare disease treatments, consistent revenue growth, and upcoming product launches position it for expansion, but its elevated valuation and risks require careful evaluation.

#3 - Kits Eyecare - KITS.TO

What does Kits Eyecare do?

Founded in 2018 and headquartered in Vancouver, Canada, Kits Eyecare operates a vertically integrated digital eyecare platform in the United States and Canada. The company manufactures and sells contact lenses, eyeglasses, and frames under its KITS brand, while also distributing products from brands like Ray-Ban, Gucci, and Oakley.

It operates e-commerce websites, including KITS.com, KITS.ca, OptiContacts.com, and ContactsExpress.ca, supported by an advanced optical lab in Vancouver that produces single-vision glasses in as little as 15 minutes.

Kits serves a growing customer base with over 7,500 eyewear styles and online vision tools, competing with players like Warby Parker.

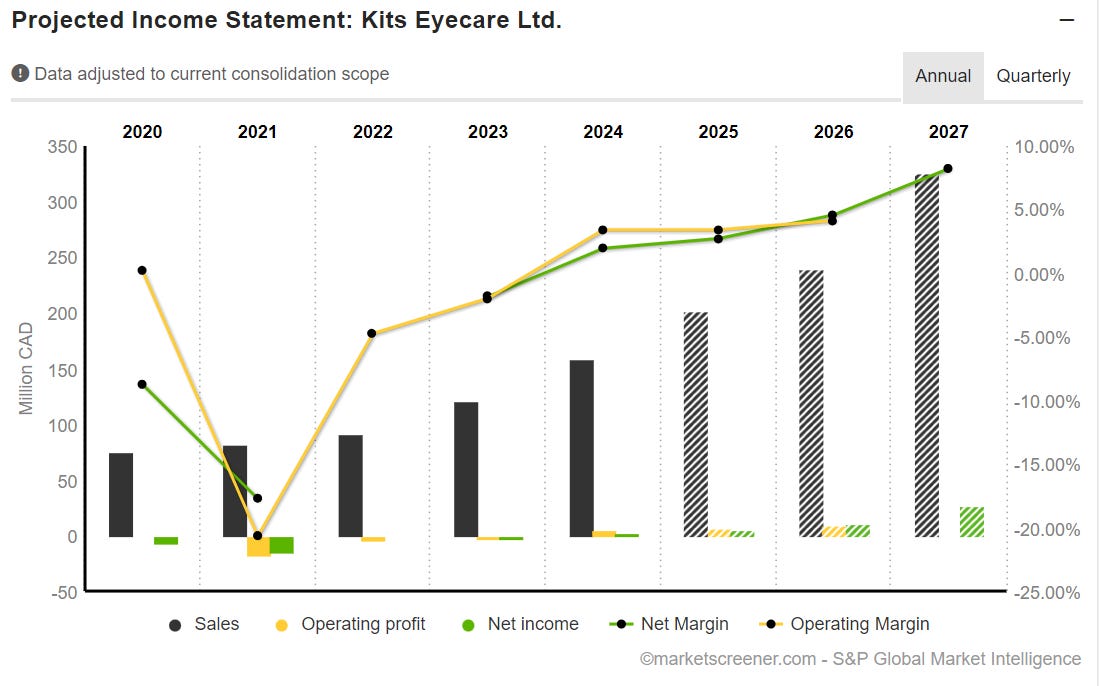

Financial Performance.

In Q1 2025, Kits reported record revenue of $46.6M, up 34% year-over-year, driven by a 46.4% increase in glasses revenue to $6.7M and delivery of 104,000 pairs. Gross profit was $17.1M, up 53.2%, with a gross margin of 36.7%, improved from 32.1%. Adjusted EBITDA reached $3.5M, up from $0.6M, marking the 10th consecutive quarter of positive Adjusted EBITDA. Net income was $1.6M, compared to $0.06M in Q1 2024. For 2024, revenue was $159.3M, up 32% from $120.5M in 2023, with net income of $3.1M. Cash balance stood at $17.7M in Q1 2025, with reduced debt.

Outlook.

Kits anticipates sustained growth in 2025, with full-year revenue projected at $200,m implying 25% growth, driven by glasses sales and U.S. market penetration (75% of revenue). The company expects to double its Vancouver lab capacity within two years with minimal capital expenditure, supporting higher margins. New product launches, like smart eyewear (Pangolins), aim to capture market share. Risks include competition from larger retailers and potential supply chain disruptions, though vertical integration mitigates these. Analysts expect continued EBITDA margin expansion due to operational efficiencies.

Valuation.

At C$14.21 per share (June 2025), Kits’ market cap is C$454.8M with 32M shares outstanding.

The trailing P/S ratio is 2.66x, below the specialty retail median of ~4x. The P/E ratio is 103x, reflecting high growth expectations. Analysts’ consensus price target is C$18.00, suggesting 27% upside, with a “Buy” rating from seven analysts. The stock has risen 64.5% over the past year.

In summary, Kits Eyecare’s strong revenue growth, operational efficiency, and U.S. expansion support its growth trajectory, though its high P/E ratio suggests valuation caution.

If you enjoyed this post, feel free to subscribe, like, and share your investment ideas in the comments. Please note that this post does not constitute a recommendation to buy or sell. I am not a shareholder of these companies.